When a TVA retiree (or an insured family member) reaches age 65, the retiree (or family member) will no longer be covered by one of the two TVA group health insurance plans known as the 80-percent Preferred Provider Organization (PPO) Plan or the Consumer-Directed Health Plan (CDHP).

At that time, the retiree or family member will be eligible for Original Medicare health insurance which covers about 80% of the cost of hospitals (Part A) and doctors (Part B) that accept Medicare patients. The remaining 20% of medical costs will be the responsibility of the individual. However, a supplement to Medicare coverage called Medicare Supplement Insurance can be purchased to cover the remaining costs. Medicare Supplement Insurance, also known as Medigap plans are sold by private insurance companies. The extent of the supplemental coverage will depend on the plan purchased (more on this later). These plans DO NOT provide prescription drug coverage. If prescription drug insurance, also known as a Part D Plan or a Medicare Prescription Drug Plan (PDP), is desired, that coverage must be purchased through a separate policy most likely from a different insurance company. (Please review the companion paper “MEDICARE BASICS” on the TVARA website)

OR:

There is another way to obtain health insurance coverage once an individual reaches age 65 and that is through the purchase of a Medicare Advantage Plan also known as a Part C Plan. These policies are also sold by private insurance companies and they provide, at a minimum, the same coverage as the original Medicare Parts A&B and may include prescription drug coverage similar to a Part D plan. With Medicare Advantage plans one premium pays for all coverage which is similar to the TVA group health insurance plans for individuals under the age of 65 with the exception that there is no family coverage option. Medicare plans are individual plans only. (Please review the companion paper “MEDICARE BASICS”)

The process for selecting Medicare coverage by the TVA retiree or family member approaching age 65 is fairly straight forward. Basically the individual can:

1. Respond to the letter from Centers for Medicare & Medicaid Services (CMS) to sign up for Original Medicare insurance and do nothing else, or

2. Purchase additional coverage to Original Medicare (a Medigap Plan) or an Advantage Plan through a private health insurance exchange (PE) that has an arrangement with TVA to administer a Health Reimbursement Account (HRA) to pass on the TVA Healthcare Credit or Contribution, or

3. Purchase additional coverage to Original Medicare (a Medigap Plan) or an Advantage Plan directly from insurance companies through their agents or independent insurance agents or insurance brokers either in person, by telephone or online

TVA has contracted with Willis, Towers Watson (WTW) a personnel services consultant that operates a PE called Via Benefits. Private health insurance exchanges such as Via Benefits provide the purchaser the ability to easily compare several different policies and prices listed on the PE that are usually, but not always, subsidized through a defined benefit from the employer. For this reason, retirees receiving financial assistance from TVA such as the Healthcare Credit or Contribution for the purchase of health insurance in addition to Original Medicare MUST select their additional insurance through Via Benefits (more on this later). Via Benefits also provides a benefits advisor who will ask questions to determine the health situation and provide suggestions to assist in the selection of additional medical insurance coverage beyond Original Medicare benefits. Via Benefits will begin contacting individuals between 6 and 12 months prior to their 65th birthday and can be reached at (844) 620-5725.

To assist Medicare eligible individuals in making insurance purchase decisions, Medicare provides a 160+ page guide titled Medicare & You (the white book) approximately 3 months prior to month the individual turns age 65. https://www.medicare.gov/medicare-and-you

But, what may be the best source of personalized assistance in addition to Via Benefits is the State Health Insurance Assistance Program (SHIP). The SHIP phone number for the appropriate state is printed on the back cover of the Medicare white book which will be needed to contact their advisors. For Tennessee it is 1-877-801-0044. The phone number for any state can be obtained online at https://www.medicare.gov/contacts/ and selecting the appropriate state and “SHIP”.

As stated earlier, Via Benefits will begin consulting with the retiree/family member about one year before the 65th birthday. The insurance advisors are salaried employees of WTW and are not paid a commission even though a statement mandated by the government will be recited by the adviser stating they might receive a commission. They don’t, but they do benefit from the results of a customer satisfaction survey.

Once the initial consultation with Via Benefits is completed, call the state SHIP. Each SHIP is familiar with ALL health insurance available to individuals living in that state. SHIP provides the same consultation service as does Via Benefits and it is also free. The advisors for SHIP do not sell insurance and are mostly volunteers. There are TVA retirees that are volunteer insurance advisors for SHIP. Obviously they are not paid a commission either. Given the same information they should give a similar recommendation on the type of insurance to purchase, Original Medicare + a Medigap Plan + a Part D Prescription Drug Plan or a Medicare Advantage Plan. However, since they are not limited to a particular insurance exchange, they will have access to more providers and more prices for the same coverage desired.

Next, get online with Medicare at https://www.medicare.gov/sign-up-change[1]plans/decide-how-to-get-medicare/your-medicare-coverage-choices.html and go through the same process. Once again, the same health information should generate similar results. Also, there are a host of online Medicare supplement websites and many retirees have reported good results in obtaining a health insurance policy through them. These are insurance brokers. You can also go directly to an insurance company’s website and get a quote. During the late summer and fall there are a number of information sessions hosted by insurance company agents and independent brokers in motels, community centers, senior centers, etc. These are also good sources of information.

In the months before the retiree or family member becomes eligible for Medicare, the retiree will receive a letter from TVA containing an estimated recalculation of the TVA Healthcare Credit or Contribution. The transition to Medicare coverage will reduce the amount of the credit and in some cases to the extent that it will be zero or no longer a significant factor in the decision to use the HRA through Via Benefits. Some retirees found it more economical to purchase medical insurance outside of Via Benefits and forgo the credit. More information on this is provided in the sections on the TVA Healthcare Credit and HRA below.

Regardless of purchasing additional insurance through Via Benefits or directly from the public health insurance marketplace, the choice is the same: an Advantage Plan or Original Medicare plus a Medigap Plan and a Medicare Prescription Drug Plan. (Please see the paper on MEDICARE BASICS for a more detailed description of these choices).

Prescription Drugs

Original Medicare and Medigap plans don’t cover prescription drugs so a standalone Medicare PDP is needed if Original Medicare is selected along with the purchase of a Medigap plan. Once again, start with the advisors at Via Benefits, move on to the advisors at SHIP, check out the Medicare & You white book and look at https://www.medicare.gov/part-d/index.html. Ensure that the PDP covers your prescriptions and focus on the estimated annual cost. Use the Medicare.gov website for these cost estimates to compare with estimates provided by others such as Via Benefits and insurance brokers especially if the estimates include tier 2 and tier 3 drugs. Compare the annual cost of drugs and not just the premium. The annual cost takes into consideration out of pocket costs such as the operation of the deductible, drug costs AND the premium.

The prescription drug insurance plans provided by insurers change so often that they have open enrollment every year from October 15 to December 7. Medicare strongly encourages individuals to re-shop drug plans every year.

For prescriptions eligible for refill, individuals “aging-in” may want to consider placing an order for prescriptions just before losing the group insurance plan to allow time for selecting and obtaining new prescription drug insurance. Check with the new PDP insurer on which prescription refills might be switched to them and which drugs will need new prescriptions sent to them.

For those unfortunate few that have a drug that is not listed on any insurer’s prescription drug formulary, it is suggested that the lowest estimated annual cost plan that covers the rest of the drugs be selected knowing that the process of filing an exception with your new PDP insurer for the drug in question will have to be followed. Every PDP provider must have a transition policy to ensure that new members have uninterrupted access to the drugs they were already taking before they joined. The new plan’s transition policy must cover at least one temporary 30-day supply of drugs not on the formulary and not apply any plan restrictions (such as prior authorization and step therapy). This policy is in place for the first 90 days the individual is enrolled in the new plan. The pharmacist may need to ask the plan for its override code in order to bill correctly. Remember to use the drug insurance card to ensure credit for all out-of[1]pocket costs from both retail and mail-order purchases regardless of plan coverage. This will be important in moving from one stage to the next in the new drug insurance plan. However, if an individual believes that there will not be annual drug charges sufficient to move beyond the deductible, for example, it may be more economical to ask the pharmacy for the cash price and use a drug discount card rather than request coverage under the PDP. In this case the PDP is being used for catastrophic coverage only and the policy with the highest deductible and therefore the lowest premium should be considered.

If a prescription drug plan is not selected when an individual is first eligible, there will be a penalty paid every month for late enrollment when a policy is finally selected. For more information see https://www.medicare.gov/part-d/costs/penalty/part-d-late[1]enrollment-penalty.html

TVA Health Care Credit

The healthcare credit from TVA is NOT the Supplemental Pension Benefit (SPB) shown under Benefits on the TVA pension statement. The SPB is provided by TVARS and is a vested benefit. This TVARS benefit is provided regardless of health insurance decisions.

The TVA healthcare credit is calculated by considering years of service, base pension, the TVARS SPB, the TVA Contribution if any and the cost of insurance. Previously, the cost of insurance was the premium for the PPO or CDHP for covered individuals less than age 65 and the premium for the TVA Medicare Supplement Group Plan for Medicare-age individuals. Since the TVA Medicare Supplement was terminated at the end of 2016, TVA uses the last premium of $290 as the cost of health insurance for Medicare age individuals in the healthcare credit calculation rather than the actual premium paid. The cost of insurance used in the calculation for individuals still covered by the less than age 65 retiree group plan is the current TVA PPO or CDHP premium.

Note: As mentioned earlier, since the cost of health insurance decreases once a retiree or family member is covered by Medicare, the TVA healthcare credit also decreases, often significantly.

Health Reimbursement Account

If an individual is receiving financial assistance from TVA for the purchase of medical insurance (either the Health Care Credit and/or Contribution) and if the assistance continues to be greater than zero after the retireee or family member picks up Medicare coverage, TVA will provide this support through the operation of a Health Reimbursement Account (HRA). Since this “defined benefit” is offered through the PE operated by Via Benefits and Via Benefits is the HRA administrator, the Medicare age individual MUST go through Via Benefits for the purchase of medical insurance to continue to receive this assistance from TVA.

If the individual is receiving a TVA Healthcare Credit, regardless of going through Via Benefits and there are non-Medicare individual(s) covered by TVA’s less than age 65 group health insurance plan, the TVA credit will continue to be used to reduce the cost of the non-Medicare individual’s medical insurance deduction from the sponsor’s pension. If this credit is less than the cost of insurance, which is usually the case, there will be no need for a HRA. However, if the credit is greater than the cost of insurance, the remaining balance of the credit will be transferred to the HRA and the individual will have to purchase additional insurance through Via Benefits to gain access to the HRA. Via Benefits issues a HRA debit card to access the balance of this credit.

Military Insurance

Retired military individuals aging-in to Medicare and have not already switched to Tricare-for-Life (TFL) will discover that now is the time to use TFL as the Medicare supplemental plan. It is similar to the TVA group coverage (less vision & dental) at a cost unmatched in the commercial health insurance market. Vision and dental coverage can be purchased separately from TFL providers.

Alabama Retirees

A footnote for Alabama retirees: A Medigap plan from Blue Cross Blue Shield of Alabama (BCBS-AL) will be a Medigap Select Plan. Medigap Select plans require participation in a network in the “home” state. BUT, the BCBS-AL Select network is extensive with 98% of the hospitals in Alabama and more than 11,000 Alabama physicians participating. Medigap Select plans operate like any other standard Medigap plan outside the home state. This is an important issue for those living in extreme northeast Alabama where the Primary Care Physician and health facilities may be in Chattanooga, TN for example. If the physician is outside of Alabama it would be wise to call their office and ask the insurance person to check for BCBS-AL Medigap Select coverage. For more information call the Consumer Insurance Division, Blue Cross and Blue Shield of Alabama, 205-220-7681.

Finally, before losing the TVA group health insurance plan due to age (the last day of the month before your 65th birthday), take advantage of the TVA group plan’s vision benefit, the hearing benefit (audiology screening – especially if hearing aids are needed) and the preventive care benefit. These either do not exist or are different under Medicare.

So, What Policy Should You Choose and From Whom?

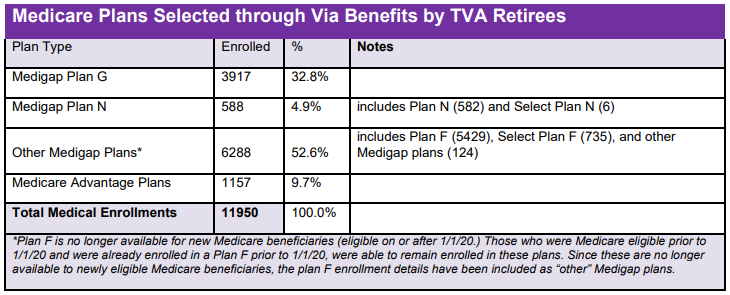

The best policy depends on many factors such as budget, coverage/features, health condition/needs, customer service, etc. Most TVA retirees purchasing an insurance plan through Via Benefits (which represents more than 70% of all retirees and beneficiaries 65 and over) chose Original Medicare and picked up the now closed Medigap Plan F as their supplemental plan rather than an Advantage plan. Many new aging-in retirees will probably be selecting the Original Medicare and a standard Plan G supplement as it is most similar to the very popular Plan F which in turn was most similar to the TVA group plan in coverage. However, some may find that Plan N with a lower premium than Plan G more attractive even though it requires a copay capped at $25 for each doctor visit and $50 for each ER visit. Others may find the lower premium of a high deductible policy more valuable if they are healthy (have near zero medical cost or can afford the high deductible out-of-pocket exposure) and just want to insure against a health catastrophe at a very low premium cost.

Customer service is a very important factor and the top 5 medical policy providers chosen by TVA retirees through the Via Benefits insurance exchange have been:

• BCBS of Tennessee

• AARP Medicare Supplement Insured by UnitedHealthcare

• Humana

• Anthem Blue Cross and Blue Shield

• BCBS of Alabama

While the top 5 Prescription Drug Plan (Part D) providers have been:

• WellCare

• Aetna Medicare

• Humana

• AARP Part D from UnitedHealthcare

• CIGNA

To view or download more details on Medicare and get the official Medicare manual “Medicare and You”, use the link below: